Speaking to Intercalation, Callum McGuinn explores what has been happening in battery patent oppositions at the European Patent Office (EPO) over the past two decades, offering a unique perspective on the fights over rights to battery innovation in Europe.

If you develop a great idea and tell the world about it, chances are it won’t be long before somebody else comes along with a copycat product, slightly undercutting you on price and stealing valuable market share from your business. One way to prevent this is to obtain a patent covering your idea – with patent protection in place, anybody else would need to take a licence from you first before taking a slice of the market. Or you could stop everyone using your invention and keep the entire market pie for yourself. Any legal entity can apply for a patent, from a lone inventor working in their shed all the way up to multinational organisations.

This article explores what has been happening in battery patent oppositions at the European Patent Office (EPO) over the past two decades, offering a unique perspective on the fights over rights to battery innovation in Europe.

Introduction:

When a patent is granted by the European Patent Office (EPO), this is not necessarily the end of the story. For 9 months after the grant date, competitors have the right to submit an opposition. To do so, they must have valid reasons, which could include:

- the invention not being patentable – not all types of invention are, and even patentable types need to be new and non-obvious over all the information currently available;

- the patent does not disclose enough information to be able to successfully repeat the invention (i.e. the patentee tried to have their cake and eat it!); or

- the patent tries to protect more than was originally disclosed in the application.

Even once judges come to a decision, the story still may not be over. Either side could appeal the decision. The Board of Appeal (BoA) of the EPO will then review the appeal and make a final decision1.

Oppositions at the EPO

Reviewing the data on the number of battery patents granted, and how many of those granted patents are then opposed by competitors, can provide valuable insight into commercial activity within the battery community.

Over the last two decades, the number of granted battery patents at the EPO has been on the rise (Figure 1, bars). This trend of course correlates with the general advancements in battery technology over the same period2.

Figure 1:

(Figure 1: The number of granted battery (IPC H01M) patents at the EPO from 2003-2023. Also plotted is the percentage of granted patents opposed over this time period).

While there has been an increase in the number of patents granted for batteries, the percentage of granted patents opposed has decreased and seems to have plateaued (Figure 1, line). And the percentage of battery patents opposed annually recently (around 1%) is notably lower than the percentage seen more generally across all European patents (more like 3-4%).

So why are more patents being granted, and yet so few battery patents being opposed? And why isn’t the proportion of opposed patents increasing as the battery field becomes more established, competition intensifies, and businesses become more IP-savvy?

2 If you want to oppose a European patent, there are almost always some promising arguments to be found, or documents which the patent examiner overlooked. So, it’s safe to say that the low number of oppositions doesn’t mean that all the patents being granted are bulletproof.

We can speculate that there may have been a decrease in the significance of patents granted, so they do not severely disadvantage competitors, or that advancements have occurred in new areas without concerned competition.

What we can say for certain is that:

- more patents are being granted in the battery sphere than there were 20 years ago,

- a patent granted today is statistically less likely to be opposed than it was 20 years ago,

- for the last ~10 years the proportion of opposed battery patents has dropped quite significantly.

This suggests that battery companies are either less willing to oppose competitor rights than they were (e.g. due to a concern about cost or uncertainty of the outcome), or (more worryingly) may not appreciate the risks of letting overly broad patents which could be asserted against you go unopposed

If a patent which arguably covers your product or process is granted and not opposed, the proprietor could then apply to a court for an order against you. This could include an injunction, which would immediately stop you selling your wares, sounding a death knell for most businesses, especially smaller ones. It could also include surrender of your products to the proprietor, or cash damages paid to them as compensation for the infringement. Then there’s the legal costs of defending the case – such infringement lawsuits would be expensive to defend, even if you truly believe the patent is invalid or you are not infringing.

EPO oppositions are a way to act early and quickly against problematic patents, significantly reducing these business risks – they can be an investment in the future security of your business.

Once opposed, roughly 30% of all oppositions at the EPO result in a patent being completely revoked, equivalent to it never existing in the first place. The average number of battery patents revoked over the last 20 years follows a similar pattern. Roughly another 30% of opposed patents have their claims limited during the opposition.

So, on average, you’d have about a 60% chance of the patent you oppose being either narrowed (hopefully so that it no longer covers your activities), or completely revoked. Your chances could be even higher if you work with a good patent attorney with opposition experience and knowledge of battery technology (quick plug: Mewburn Ellis have both). As a result, you reduce your risk of being dragged into costly patent litigation later, or having to pay royalties to patent holders from the sale of your products.

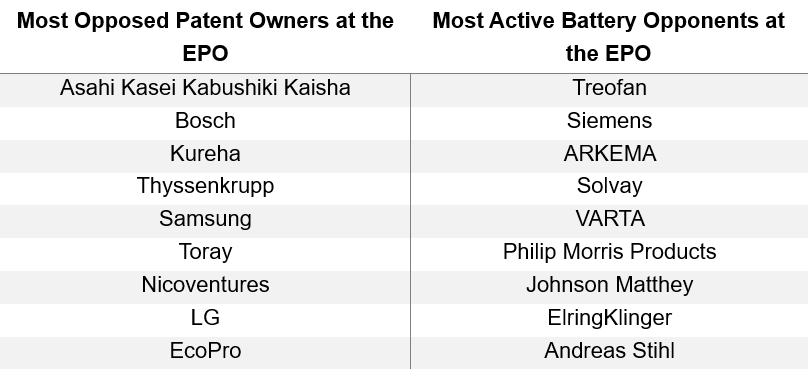

The names in the ring

Some of the most active opponents in the battery field recently include Treofan, Siemens and Arkema (Table 1). Treofan is perhaps a surprising name here as they are not a “battery business” as such, but a manufacturer of biaxially orientated polypropylene (BOPP) films – their oppositions are directed towards patents which cover films/membranes used as cell components. This also reveals that securing patents for battery-related inventions could open doors to commercialisation (including licensing) across a wide number of related technical fields.

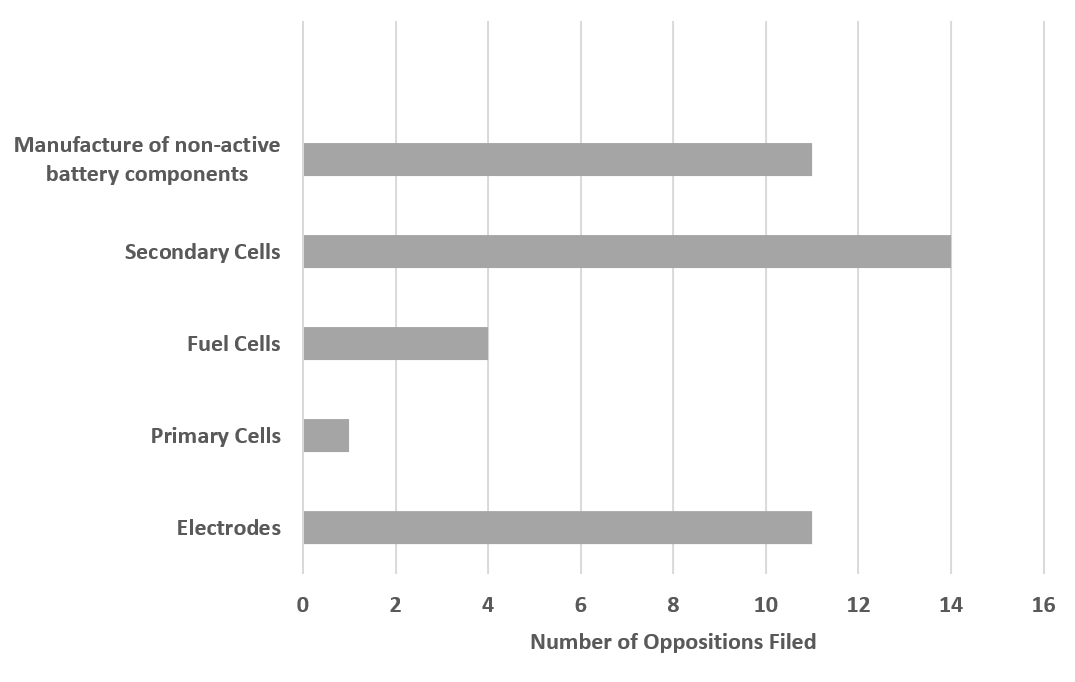

Figure 3 gives us an idea of the specific areas of battery research being opposed at the EPO, suggesting these are currently the more commercially relevant areas where companies are trying to clear the way. Patents for electrodes and secondary cells were amongst the most commonly opposed. The large difference in oppositions between secondary cells and primary cells aligns with the global push towards a more sustainable future.

(Figure 3: Patent subject matter of the last 30 oppositions at the EPO (when multiple categories are covered by a patent it is counted in both categories)).

It is more important than ever for companies who are commercially active in the battery area to actively monitor competitor IP rights and take robust clearance action where necessary, which might include submitting oppositions to granted European patents.

Battery patent holders are no longer resting on their laurels, and so companies at risk of infringement can equally no longer carry on regardless and must carefully assess IP risk when planning to manufacture or sell a product, or carry out a process.

For more information - get in contact today - callum.mcguinn@mewburn.com.

This blog was originally published by Intercalation Station.

1The European Patent Office from here.

2Comic by Legally Drawn.

Callum is experienced in the drafting and prosecution of patent applications in the chemistry and materials fields. He represents clients in oppositions and appeals at the EPO and conducts extensive freedom to operate analyses. He has significant expertise in Energy Storage technology particularly battery materials, predominantly lithium ion battery materials.

Email: callum.mcguinn@mewburn.com

Sign up to our newsletter: Forward - news, insights and features

Our people

Our IP specialists work at all stage of the IP life cycle and provide strategic advice about patent, trade mark and registered designs, as well as any IP-related disputes and legal and commercial requirements.

Our peopleContact Us

We have an easily-accessible office in central London, as well as a number of regional offices throughout the UK and an office in Munich, Germany. We’d love to hear from you, so please get in touch.

Get in touch